Mobile payments continue to drive the digital payments transformation – Central Bank

The central bank of Rwanda says that the mobile payments continue to drive the digital payments transformation in the first quarter of 2022; this comes after people were encouraged to shift to cashless system in order to prevent the spread of covid-19.

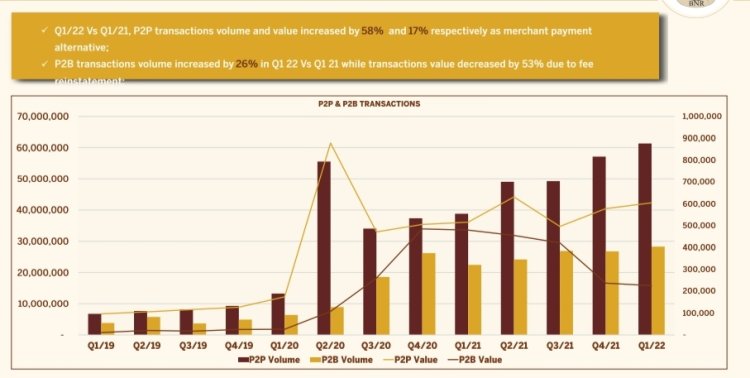

According to central bank, the person to person (P2P) volume transactions almost doubled in 2022 Q1 compared to 2021 Q1 and increased by almost 5-fold compared to 2020 Q1 (pre-covid 19) to 61.3 million transactions during 2022 Q1.

On the other hand, the person to business (P2B) volume transactions increased by 26 percent compared to 2021 Q1 and more than quadrupled compared to 2020 Q1 increasing to 28.3 million transactions. In terms of value, P2P transactions increased by 247 percent when compared to the pre-covid 19 pandemic level of 2020 Q1 to FRW 604 billion.

P2B value of transaction decreased by 53 percent compared to 2021 Q1 to FRW 226 billion following the re-introduction of merchant charges on mobile money payments (albeit at a lower rate of 0.5 percent compared to the 1 percent rate of pre-covid 19). Despite this decrease, the value of transactions was still 763 percent higher than the value recorded in 2020 Q1.

Despite the instability in world’s economy and the continuous increase of inflation, John Rwangombwa, The governor of the Rwandan central bank affirms that the payment systems remain safe and resilient.

Francine Andrew

Francine Andrew